US President Joseph Biden has signed, among the barrage of executive orders, an extension of the Eviction Moratorium through at least March 31st, allowing federally-backed mortgage forbearance applications continuance. Landlords all over the country groaned, some deciding to sell and relieve themselves of the associated complications, other savvy investors on the swoop for good investments to come on the market and tenants struggling to pay rent at once relieved and concerned that overstaying their welcome could result in serious consequences for them and their credit well beyond Covid. Nearly one in five tenants is as per the US Census Bureau, now behind

The moratorium, instituted at the end of 2020 and to have expired at the end of January, is part of Biden’s ambitious $1.9 trillion American Rescue Plan.

The original CARES act was signed in March of 2020 and as per NOLO:

“The Order protects tenants who:

- have used their best efforts to obtain government assistance for housing

- are unable to pay their full rent due to a substantial loss of income

- are making their best efforts to make timely partial payments of rent, and

- would become homeless or have to move into a shared living setting if they were to be evicted.

In addition to the above requirements, one of the following financial criteria must apply. To qualify for protection, tenants must:

- expect to earn no more than $99,000 (individuals) or $198,000 (filing joint tax return) in 2020

- not have been required to report any income to the IRS in 2019, or

- have received an Economic Impact Payment (stimulus check) pursuant to Section 2201 of the CARES Act.”

Facing an estimated $70 billion in back rent nationwide, tenants faced February evictions, the plan allocated by late January $25 billion for up to 12 months of any past-due rent, future rent, utility bills, or other housing costs for low- and moderate-income households “who have lost jobs are or are out of the labor market.” or otherwise prove financial hardship due to the pandemic. Household income is limited to no more than 80% of the median

income for your area. Vermont median income was approximately $63,001 in 2019. The longer it takes for financially stressed tenants to their aid applications, the longer it will take for their landlords to get paid and those tenants may end up facing evicition if that’s not done in time. Important to consider: the moratorium doesn’t prevent evictions, it just postpones them.

Doug Bibby, the National Multi-Family Housing Council President last year adroitly pointed out that “An eviction moratorium will ultimately harm the very people it aims to help by making it impossible for housing providers, particularly small owners, to meet their financial obligations and continue to provide shelter to their residents” and called for related property owner assistance. Here’s some great info on the Vermont Residential Housing Stabilization Program including info on the Landlord Economic Assistanct Program.

Landlords have bee very natively affected too in some cases and civil courts have been closed leading to massive backlogs. Some lessors are evicting finding other reasons such as selling drugs on the property or posing a threat to other people or property. Here’s a font of eviction related info from the Vermont Judiciary to review including information for both tenants and landlords. Every case is unique and consulting a real estate attorney experienced in evictions for expert kowledge is recommended. Vermont’s Legal Help Website outlines eviction process steps here including info on Vermont law S.333 staying evictions. Landlords may not:

- start an eviction solely for non-payment of rent or other fees or charges

- charge any late fees or penalties for late payments of rent, or

- give a 30-day notice to vacate for any reason

As Sir Captain Tom Moore, the wonderful British centarian that died of Covid this week put it in this great interview with soccer star David Beckham, “Things are bad but they will get better, they always have got better and don’t feel too miserable about it.”

An amazing recovery is already in it’s infancy with increasing Covid vaccination dissemination and falling Covid rates: the light is finally at the end of the tunnel which will bring sunshine into everyone’s lives as well as reducing vacancies, evictions, non-payment of rent and an improvement in tentant welffare leading to an increase in home ownership. From this great tragedy is bound to come an incredible revival. It’s a wonderful time with still historically low interest rates to invest in rental properties, multi-families or a single family home for yourselves.

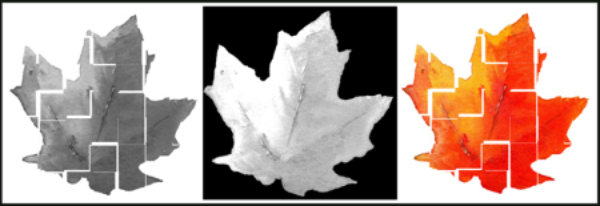

Maple Sweet Real Estate is bullish on Vermont and so appreciates serving you, your family and broader network, delving deeply into myriad issues affecting Vermont property owners, sellers, and purchasers.

Connect to maplesweet.com, e-mail info(at)maplesweet(dotted)com or call toll-free 800.525.7965 for info on selling or purchasing Vermont commercial properties, homes, condos or land or to get more information on Vermont real estate.

See all Maple Sweet Real Estate listings and the newest Vermont listings.

Referrals & recommendations are welcome & appreciated.

Vermont Mandatory Consumer Disclosure: please note Vermont real estate agencies represent Sellers directly or indirectly. Buyer representation can be gained for properties not already listed by Maple Sweet Real Estate. To better understand the merits of or arrange for buyer representation, please email or call for further details.

Information Disclosure: information provided and relayed by Maple Sweet Real Estate is not represented to be accurate or free of errors. While substantial efforts are made to obtain and convey information from sources deemed dependable, Maple Sweet Real Estate does not guarantee or warranty such information is accurate or reliable. All information should be independently verified.

tapping into vermont

tapping into vermont