Vermont’s forests

are lush with treasure. Exquisite tiger maple, hemlock for tenacious post and beam house frames, sweet maple sap which sugared down, covers pancackes across the land and gives our green mountain state a claim to fame.

Defining Current Use

What then is Vermont’s Current Use Program? It’s often referred to as “the most important, most successful conservation program in Vermont.”

If you own 27 or more acres, you’re already likely familiar with this increasingly popular land tax reduction and deferral opportunity, but to the layman less familiar with tree related tax breaks, the name Current Use itself is cryptic enough without tackling taxation intricacies.

Current Use landowners practice long term forest management to achieve taxation based on forest valuation vs fair market valuation. This very substantial savings which can be as much as 70 to 80 per cent of what the taxes would be otherwise, comes at a cost. The state attaches a permanent lien to the deed until such time as the landowner withdraws, the legislature ends the program, or the parcel is discontinued by the Division of Property Valuation & Review.

The Tax Benefits

can be huge. By placing your forest or agricultural property in Current Use you can dramatically decrease your yearly tax burden. For forested land graced with valuable timber, periodically required forest management (ready the chain saw) can yield the added bonus of incoming checks for the land owner from the logger harvesting precious hardwoods.

For forest land to qualify, you need at least 27 acres for 25 to enroll with a two acre exclusion for your house site. When purchasing land already enrolled, with the plan to continue enrollment, you can’t move the excluded area but, assuming you have well over 25 acres, you can withdraw another section to build your home, though you’ll incur a land use change tax. This withdrawal penalty is also levied if you decide to withdraw the entire property from current use. One of the most common questions and concerns: so how much will it cost me to withdraw from the program?

Use Change Tax Calculation

Elizabeth Hunt, one of the three Current Use personnel listed on Vermont’s current use website is immensely helpful. According to Elizabeth, Use change tax determination is based on the assessed value of the land enrolled divided by the town’s CLA, or Common Level of Appraisal or Adjustment, the tax department’s attempt to adjust assessed values to fair market value. To get the state’s assessment of your enrolled current use acreage, call Elizabeth or the state’s current use department. Once you’ve divided the enrolled acreage current use assessment by the CLA, and multiplied that figure by the percentage of the number of acres being withdrawn, you’ve got your alleged fair market value of acreage being withdrawn. Your use change penalty depends on how long the land’s been in current use. If ten or more years, the penalty is ten per cent of the fair market value of the land being withdrawn; if less than ten years, then 20 per cent.

H.237, a bill intended to strengthen the current use tax base, proposed a change in the percentages the use change tax is determined by. Property held less than 12 years would incur 10%, property held 12 to 20 years 8%, and property held over 20 years just five per cent. It passed the House in 2011 but not the Senate. An effort was made to incorporate it into miscellaneous tab bill H.782 this year but it stalled in the Senate Finance Committee. Proponents of the bill include the Vermont Natural Resources Council.

For more details on penalty calculation see pages 16-18 of Vermont UVA (Use Value Appraisal) manual. Family members can step into the shoes of a current use owner but new owners inheriting an unrelated property owner’s current use land have to start the clock ticking all over.

For more details on the entire program, see the same manual and the Vermont Division of Forestry site.

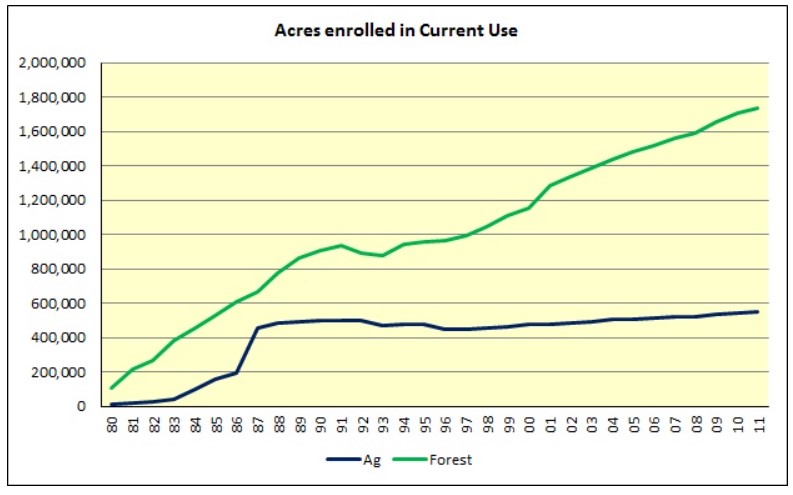

The Vermont graph below shows the increasing popularity of Current Use, especially in Forest.

Foresters, Loggers & Harvesting

Engaging a forester to prepare your forest management plan may run up to a couple of thousand, varying, including application fees.

Be sure to get a contract with your logger once you get that far. There are stories of property owners wondering what happened to their checks once the loggers were long gone.

Vermont County Foresters are excellent resources for current use information and can recommend non-county foresters to prepare forest management plans and help you oversee your forest during program inclusion, as well as recommend dependable and honest loggers to work with.

Click here for a Current Use Application, and here for a Change of Ownership Form.

Before cutting any of your enrolled forest, you or your forester must submit your forest management plan, or all the land must exit the program, a change tax levied, and eligibility denied for the ensuing five years during which taxes would go back to normal.

If your management plan calls for cutting but the timber values are depressed, you can delay cutting up to a couple of years with county forester approval.

On harvest yield, you might expect 1,000 to 1,500 board feet per acre. Harvesting may occur every ten years or more. Wind throw from storm damage can necessitate cutting earlier.

Connect to maplesweet.com, e-mail info(at)maplesweet(dotted)com or call toll-free 800.525.7965 to arrange for showings, list your property, arrange for showings, or look further into Vermont’s real estate market or Act 250 reform.

See all Maple Sweet Real Estate listings, the newest central & northern Vermont mls listings, or connect to a hand picked selection of central & northern Vermont properties.

Vermont Required Consumer Information Disclosure: please note Vermont real estate agencies represent Sellers directly or indirectly. Buyer representation can be gained for properties not already listed by Maple Sweet Real Estate. To better understand the merits of or arrange for buyer representation, please email or call for further details.

tapping into vermont

tapping into vermont