Vermont Property Transfer Tax (PTTR)

A one-time tax hits when real estate changes ownership and the buyer pays, separate from the purchase price, at closing.

The PTTR changed dramatically about a year ago on August 1st of 2024.

Here’s what you need to know as a potential Vermont property purchaser, based on information from the web and the Law Office of Fred Peet.

The good news is the tax is lower for primary residence purchasers.

If you’re looking for a second home in Vermont though, the rate under most circumstances is now much higher.

Primary Residences:

-

- 0.5% on the first $200,000 of the property’s value (formerly on the first $100,000)

- 1.47% (the base rate of 1.25% plus the 0.22% clean water surcharge) on the value exceeding the first $200,000 of the purchase price.

- Qualifying financing exemption: The first $250,000 of the property’s value is fully exempt from the transfer tax if a purchase money mortgage is secured through the Vermont Housing and Conservation Trust Fund, Vermont Housing and Finance Agency (VHFA), or USDA Rural Development, with the 1.47% rate applying to amounts over $250,000.

- Non-Primary Residences

- A 3.62% rate (base rate of 3.4% + the 0.22% clean water surcharge) may apply to certain second homes (residential, year-round habitation, not primary residence, and not requiring a landlord certificate).

- A lower 1.47% rate (including the clean water surcharge) applies to other non-primary residences, such as unimproved land, seasonal camps, commercial properties, and long-term rental properties.

This last non-primary exemption, long term rentals, offers a hot loop hole for second home buyers open to flexibility after closing.

If you are buying a 2nd home, you can effectively avoid the much higher 3.62% PTTR by renting your new 2nd home out for at least 30 consecutive days a year.

One way to skin this cat is to fold a rent-back to seller contingency into your offer/contract.

If you rent back to the seller for the first 30 days after closing, the 1.47% rate would apply instead of the 3.62%.

For example, and especially attractive to those purchasing more expensive real estate, on a one million dollar sale, your transfer tax would drop from $36,200 to just $14,700, a whopping $21,500 savings (a sweet hot tub!), not to mention any rental fee folded in for the 30 day rental.

On a $500k purchase, The $18,100 PTTR would be just $7,350, a $10,750 savings, still potentially substantial enough to warrant folding in the rent-back contingency or renting out the house for at least 30 days at some point.

Here’s a more detailed example table of potential PTTRs.

| Home Price | Primary Residence (No Special Financing) | Primary Residence (Special Financing) | Non-Primary Year-Round Home | Other Properties (seasonal, land, long-term rental) |

| $100,000 | $500 | $0 | $3,620 | $1,470 |

| $200,000 | $1,000 | $0 | $7,240 | $2,940 |

| $300,000 | $2,470 | $735 | $10,860 | $4,410 |

| $400,000 | $3,940 | $2,205 | $14,480 | $5,880 |

| $500,000 | $5,410 | $3,675 | $18,100 | $7,350 |

| $750,000 | $9,080 | $7,350 | $27,150 | $11,025 |

| $1,000,000 | $12,750 | $11,025 | $36,200 | $14,700 |

For those folding the rent back into the offer/contract, you’d need to file a Landlord’s Certificate form LC-140 with the state which is free of charge at www.mytax.vermont.gov and your attorney would file form PTT-172, the Vermont Property Transfer Tax Return at the same time as they file the deed for recording with the town clerk.

There is no statutory deadline for deed/transfer tax form delivery, but the general expectation is “as soon as practicable”.

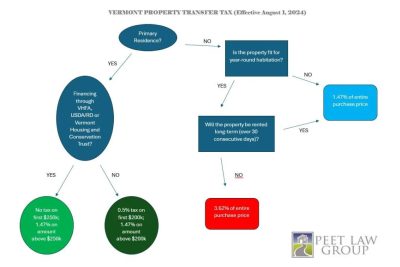

This diagram from the Law Office of Fred Peet is helpful in simplifying the PTTR.

Other PTTR exemptions:

- Transfers between close family members for no consideration.

- Transfers between married couples.

- Some inherited properties.

At Maple Sweet Real Estate, the goal is to keep you extraordinarily well informed. If you have any questions about the PTTR or anything else related to Vermont Real Estate, please contact me via email @ [email protected] or via text or call Clayton-Paul Cormier @ 1-802-793-1515.

There is a wealth of information for you too at www.maplesweet.com

tapping into vermont

tapping into vermont