Vermont, the Green Mountain State, is green for a reason.

Water.

We have an abundance, in stark contrast to Colorado and other parched western states where humidity levels are low and desert can be found.

Vermont water oozes out of the ground even in the absence of rain, delicious spring water coming forth. Many houses across the state are lucky enough to tap into this ground water resource for their drinking water. It’s so delicious, a cut above drilled well water. You can taste it.

But when the skies cloud over and the big rains come or the snowmelt flows over the river banks, watershed becomes a curse. The mountains and ridgelines serve as giant canyon walls, the valley streams and rivers swell and, under just the right circumstances, unleash floods of awesome power that can sweep away entire houses and the land underneath them.

1927 flood, two years before the Great Depression, was massive. The Federal Emergency Management Administration (FEMA) didn’t exist until five decades later, established in 1978. Hurricane Irene struck August 20th, 2011, followed by also devastating Hurricane Sandy the very next year in 2012 resulting in 13 million in private insurance claims in Vermont. Homeowners’ insurance policies don’t cover flood insurance, instead provided by the National Flood Insurance Program (NFIP).

Needless to say, when you’re buying a house in Vermont you should be well informed as to the local watershed and if it lies in any flood zone. FEMA has this fantastic mapping tool. Type in the property (residential, commercial or any other) address and hit enter or the search tab. The “View Map” tab pulls the local Flood Insurance Rate Map (FIRM) but the “Interactive Map” tab pulls a much more detailed version which makes it possible to see if even part of a house falls in the 100-year zone AE which would mean a major hike in flood insurance rates. The FEMA site has excellent information too on the various flood zones, flood insurance, and this tutorial on how to read a flood map. Zone AE includes more detailed information including Base Flood Elevations (BFEs). If a property is in the 100-year flood zone insurance rates are calculated based on the BFE and relative elevation of the lowest level of the house, including the basement floor if there is one (regardless of whether it’s a dirt or concrete floor).

Banks can require the flood insurance even if only a small portion of the land (not structure) is in the 100-year zone. If it seems clear your structure is not in the 100-year flood zone and you don’t think your lowest structure floor level, including the basement, is below the probable BFE, then it may be worth hiring a surveyor to create an elevation certificate and determine your structure location BFE (base flood elevation). Insurance agencies recommend having the BFE prepared. The ballpark surveyor cost is in the $400-$500 range. If high and dry, including the basement floor elevation relative to the BFE if you have a basement, you can file an LOMA (letter of Map Amendment) to request a change and flood zone designation and have FEMA reclassify your property as property out of the 100-year flood plain.

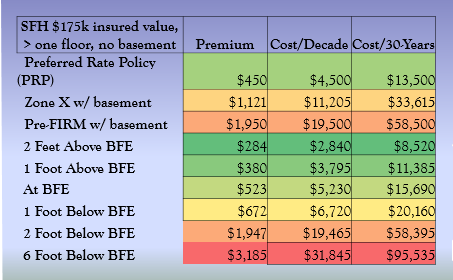

The table above is a rough (not intended to be accurate) indication of what the yearly flood insurance rate might run based on $175,000 of coverage. FEMA will insure up to $250,000 on residential and $500k on commercial and if you’re borrowing money to purchase the bank will require flood insurance if the property falls into the 100-year flood plain for the mortgage amount or structure value, whichever is least. For a basement six or more feet below the BFE, it could run several thousand or more a year. One Hancock, Vermont property owner recently received an estimate of $4,800 per year to insure $175,000 home with a basement six or more feet below the BFE, rivaling yearly taxes. Every foot is rounded up or down at the half foot mark. 5″ gets rounded down, 6″ rounded up. Local insurance agents may find it hard to even roughly estimate what your flood insurance premium might be. Agencies call the National Flood Center for rates, 800-759-8656.

Pre-FIRM (Flood Insurance Rate Map) buildings are those, as per FEMA’s website, “buildings built before the effective date of the first FIRM for a community” and before “detailed flood hazard data and flood elevations were provided” and usually “before the community enacted comprehensive regulations on floodplain regulation, designed to help people afford flood insurance (via subsidized rates) even though their buildings were not built with flood protection in mind.” Such subsidization is on a 5-25% diminishing track until rates hit market level.

For some purchasers this added carrying cost can be back breaking, lead to foreclosure and incur significantly longer marketing periods to sell. In some cases this 100 year flood zone properties suffer from dramatically lower sale prices as fewer buyers can handle the elevated level of carrying expense.

If the property falls in Zone X, the 500-year flood zone, no federal flood insurance is mandatory though maintaining a policy may make sense. To counter risk, some jack up the entire house and replace their foundations with higher foundation walls to elevate the lowest level above the BFE and avoid costly yearly flood insurance premiums. Others resignedly have their basements filled in, eliminating the sub-BFE level altogether.

Maple Sweet Real Estate delves deeply into myriad issues affecting Vermont property owners, sellers, and purchasers.

Connect to maplesweet.com, e-mail info(at)maplesweet(dotted)com or call toll-free 1-800-525-7965 for info on selling or purchasing Vermont commercial properties, homes, condos or land or to get more information on Vermont real estate.

See all Maple Sweet Real Estate listings and the newest Vermont listings.

Referrals & recommendations are welcome & appreciated.

Vermont Mandatory Consumer Disclosure: please note Vermont real estate agencies represent Sellers directly or indirectly. Buyer representation can be gained for properties not already listed by Maple Sweet Real Estate. To better understand the merits of or arrange for buyer representation, please email or call for further details.

Information Disclosure: information provided and relayed by Maple Sweet Real Estate is not represented to be accurate or free of errors. While substantial efforts are made to obtain and convey information from sources deemed dependable, Maple Sweet Real Estate does not guarantee or warranty such information is accurate or reliable. All information should be independently verified.

tapping into vermont

tapping into vermont